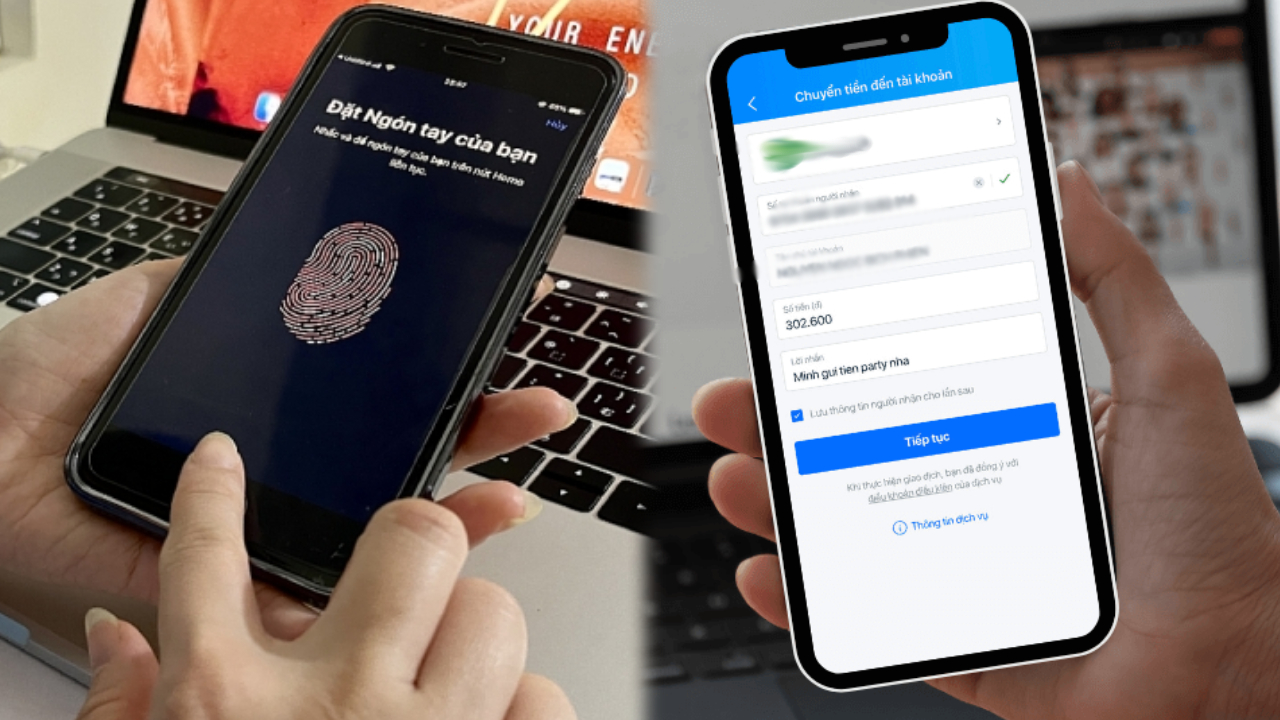

(Yeni) – Face and fingerprint authentication when transferring money are applied to improve security and minimize fraud.

Fraud in cyberspace is no longer strange to people. Despite frequent warnings from authorities and mass media, many people still fall into the trap of bad guys. Fraudsters’ methods are increasingly sophisticated and constantly changing to take advantage of people’s loopholes and lack of vigilance.

One of the most common scam scenarios is that bad guys impersonate people calling to create fake situations asking people to provide account information, login passwords, and bank authentication codes (OTP). . They often make urgent requests that need to be implemented immediately. When people are subjective, careless, and do not have time to catch information, it is very easy for criminals to commit acts of property appropriation.

From July 1, 2024, Decision 2345/QD-NHNN on implementing safe and secure solutions in online payments and bank card payments will be put into effect with the expectation of limiting the situation. Fraudulent status, cancellation of buying, selling, and leasing bank accounts.

From July 1, in some specific cases, individuals will have to perform biometric authentication (including facial recognition and fingerprint) to transfer money.

According to Decision 2345, in some specific cases, individuals will have to perform biometric authentication (including facial recognition and fingerprint) to transfer money.

Specifically, according to Decision 2345, for type C transactions in group I.3, the minimum transaction authentication measures for individual customers are:

– By the customer’s biometric identification mark:

(i) matches the biometric data stored in the chip of the customer’s citizen identification card issued by the Police;

(ii) or through authentication of the customer’s electronic identity account created by the electronic identification and authentication system.

– Or by the customer’s biometric identification mark matching the biometric data stored in the customer’s biometric database that has been collected and checked, and is encouraged to be combined with the authentication method. OTP sent via SMS/Voice or Soft OTP/Token OTP.

In particular, transactions in group I.3 include:

– Transfer money within the same bank, different account holders.

– Domestic interbank money transfer.

– Transfer money between e-wallets.

– Deposit money into e-Wallet.

– Withdraw money from e-Wallet.

A transaction in group I.3 is a type C transaction if it falls into one of the following cases:

1. Case 1: Transaction meets the following conditions:

(i) G ≤ 10 million VND.

(ii) G + Tksth > 20 million VND.

(iii) G + T ≤ 1.5 billion VND.

2. Case 2: Transaction meets the following conditions:

(i) G > 10 million VND.

(ii) G ≤ 500 million VND.

(iii) G + T ≤ 1.5 billion VND.

In there:

G is the value of the transaction.

Tksth is the total value of type A and type B transactions of each group of transaction types performed by a bank account (including transactions to deposit money into e-wallets) or an e-wallet (excluding transaction to deposit money into e-wallet). Tksth of a bank account/e-wallet is calculated as 0 at the beginning of the day or immediately after that bank account/e-wallet has a transaction during the day using authentication measures for the transaction. type C or type D epidemic.

T: Total value of transactions of each group of transaction types performed during the day (of a bank account (including transactions to deposit money into wallet.

According to the above regulations, from July 1, 2024, the following cases must be authenticated by face and fingerprint when transferring money:

– Money transfer under 10 million VND and total transfer amount per day not exceeding 20 million VND must be authenticated by OTP code, no need to authenticate by face or fingerprint.

– When transferring money over 10 million VND, authentication by face and fingerprint is required.

– Money transfer is less than 10 million VND/time but the total transactions in a day have reached 20 million, then the next transfer that day must be authenticated by face or fingerprint regardless of the value of the next transaction. how much.

In addition, individual customers must also be biometrically identified before making their first transaction using a mobile banking application or before making a transaction on a device other than the device on which they last made the transaction. .

Note that for specially controlled credit institutions, the provisions in this Decision will apply from January 1, 2025, instead of July 1, 2024.

[yeni-source src=”https://www.giaitri.thoibaovhnt.com.vn/tu-1-7-2024-tro-di-truong-hop-nao-phai-xac-thuc-bang-khuon-mat -van-tay-when-chuyen-khoan-tien-805500.html” alt_src=”https://phunutoday.vn/tu-1-7-2024-tro-di-truong-hop-nao-phai-xac- practical-state-of-hand-when-traveling-to-drill-d407892.html” name=”giaitri.thoibaovhnt.vn”]