(Yeni) – According to the new regulations, motorcyclists need to buy motorbike insurance, otherwise they will be subject to administrative penalties.

What is the penalty for not having motorbike insurance?

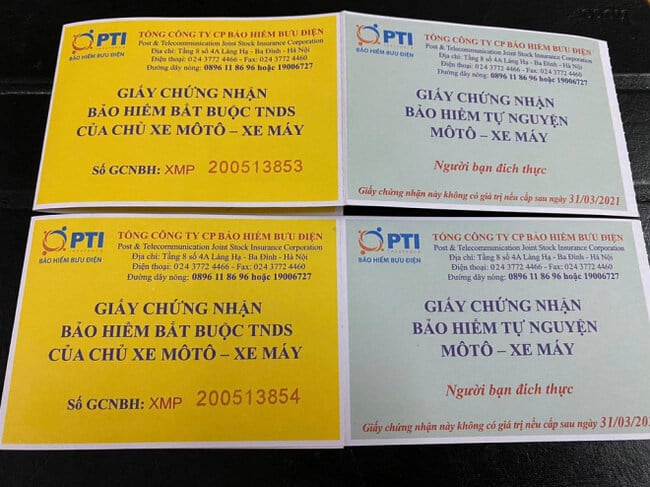

Motorcycle insurance is a familiar name used to refer to the Certificate of Civil Liability Insurance issued by the motor vehicle owner for the vehicle being a motorbike. According to point d, clause 2, Article 58 of the 2008 Road Traffic Law, drivers must carry a motor vehicle owner’s civil liability insurance certificate when operating a vehicle.

Therefore, motorbike drivers when participating in traffic must not forget to carry vehicle insurance. If the Traffic Police checks documents and cannot present motorbike insurance, the driver will be administratively sanctioned according to Point a, Clause 2, Article 21 of Decree 100/2019/ND-CP, amended by Decree 100/2019/ND-CP. Decree 123/2021/ND-CP: Fine from 100,000 VND to 200,000 VND for one of the following violations:

Drivers of motorbikes, mopeds, motorbike-like vehicles and moped-like vehicles do not have or do not carry a valid motor vehicle owner’s civil liability insurance certificate force. Thus, without motorbike insurance, the vehicle driver will be fined from 100,000 – 200,000 VND.

How much does motorbike insurance cost?

Currently, motorbike insurance fees are regulated in Appendix I of Decree 67/2023/ND-CP as follows:

– Motorcycles under 50 cc (under 50 cc): 55,000 VND/year (excluding VAT).

– Motorcycle over 50cc: 60,000 VND/year (excluding VAT).

– Large displacement vehicles (over 175cc): 290,000 VND/year (excluding VAT).

In case of purchasing motorbike insurance through apps or e-wallets, buyers can also receive preferential discount codes. Thanks to that, the actual amount of money you have to spend to buy motorbike insurance is less than the regulations.

People’s rights when buying motorbike insurance

When the traffic police check the documents, the vehicle owner is limited to being fined because civil liability insurance is a necessary and mandatory document when participating in traffic.

According to Circular 04/2021/TT-BTC: The insurance liability level for human damage caused by motor vehicles is 150 million VND/person/accident.

The level of insurance liability for property damage caused by motorbikes (including electric motorbikes) and similar vehicles according to the provisions of the Road Traffic Law is 50 million VND/accident.

For voluntary motorbike insurance, the benefits the vehicle owner receives depends on the content of the contract and agreement between the insurance seller and the insurance buyer. Buyers can choose insurance for the vehicle owner or insurance for the vehicle itself…

[yeni-source src=”https://www.giaitri.thoibaovhnt.com.vn/tu-nay-nguoi-di-xe-may-khong-mua-bao-hiem-co-bi-xu-phat-khong -muc-phat-la-bao-nhieu-776875.html” alt_src=”https://phunutoday.vn/tu-nay-nguoi-di-xe-may-khong-mua-bao-hiem-co-bi- xu-phat-khong-muc-phat-la-bao-nhieu-d395737.html” name=”giaitri.thoibaovhnt.vn”]